Incorporating Risk Assessment into Project Forecasting

Author: Dione Palomino Conde Laratta, PMP

Company: ICF International - USA

Phone: +1 (858) 444-3969

[email protected]

Subject Category: Project Risk Management and Cost Estimating

Brief author profile

Dione Laratta (MBA, PMP) has 16 years of experience in the energy industry with the last 8 years focused on project management.

She currently serves as a Project Controller with ICF International on a $200 million environmental project involving mitigation for construction of a transmission line (TRTP). She is responsible for overseeing budget forecasts, risk assessment, schedule controls, and subcontractor management using sophisticated budget managements tools that are integrated throughout the project.

Her additional project management experience includes five years as the Planning and Control Manager for a $30 billion refinery program for the third largest Oil and Gas Company in the world.

Acknowledgements

This paper presents the results of a risk assessment approach applied to an environmental project. The author wishes to express her gratitude to all who participated in the risk workshops conducted as part of this paper. The author also wishes to express my gratitude to the reviewers of this paper for their comments and suggestions.

Abstract

The science of project management was founded, in large part, to manage risk and prevent it from negatively affecting project objectives, schedules, and budgets.

Risk in any project is unavoidable. Fortunately, there are proven methods to identify and analyze potential threats so that appropriate risk responses are developed and the project's level of exposure is controlled.

Risk analysis has become an important discipline within the field of project management. It involves prioritizing risks and assessing each identified risk's probability of occurrence and potential impact, whether positive or negative.

This paper explores both qualitative and quantitative risk analysis techniques applied to the environmental industry. It explains how to incorporate risk assessment into forecasting and shows how a project was able to increase forecast accuracy from 50% to 95% by using the described approach.

Introduction

In a business world that can transform in the blink of an eye, complexity is the new norm. On top of that, add forces of nature and you are entering the environmental industry.

Forecasting for a project that can be impacted by rain, snow, drought and wild fires can be very challenging since there is always “something in the air.” To get an accurate gauge of these risks – and opportunities – across the project, project executives are appealing to risk management and incorporating its results into the forecast process.

The Risk Management Process

Risk is inherent in projects. One can never overcome all potential risks in a project, but preparation, planning and execution can mitigate much of the risk.

Successful management of a project’s risks gives you better control over the future and can significantly improve the chances of you reaching your project objectives, including scheduling and budget objectives.

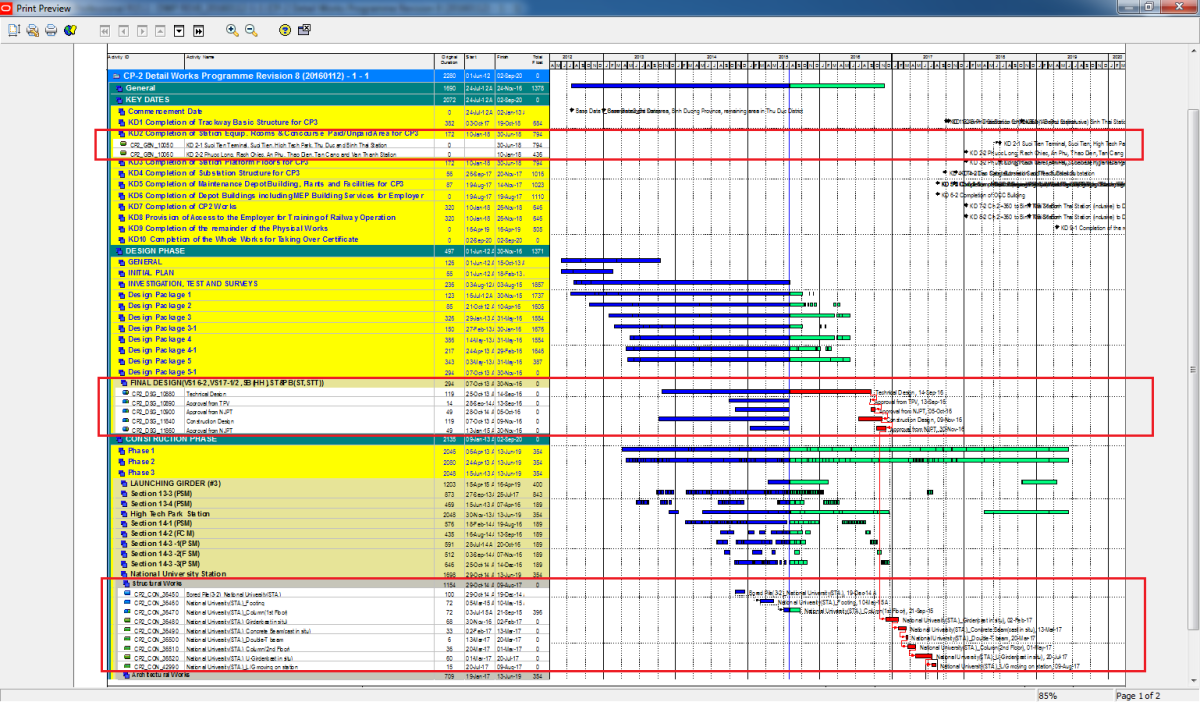

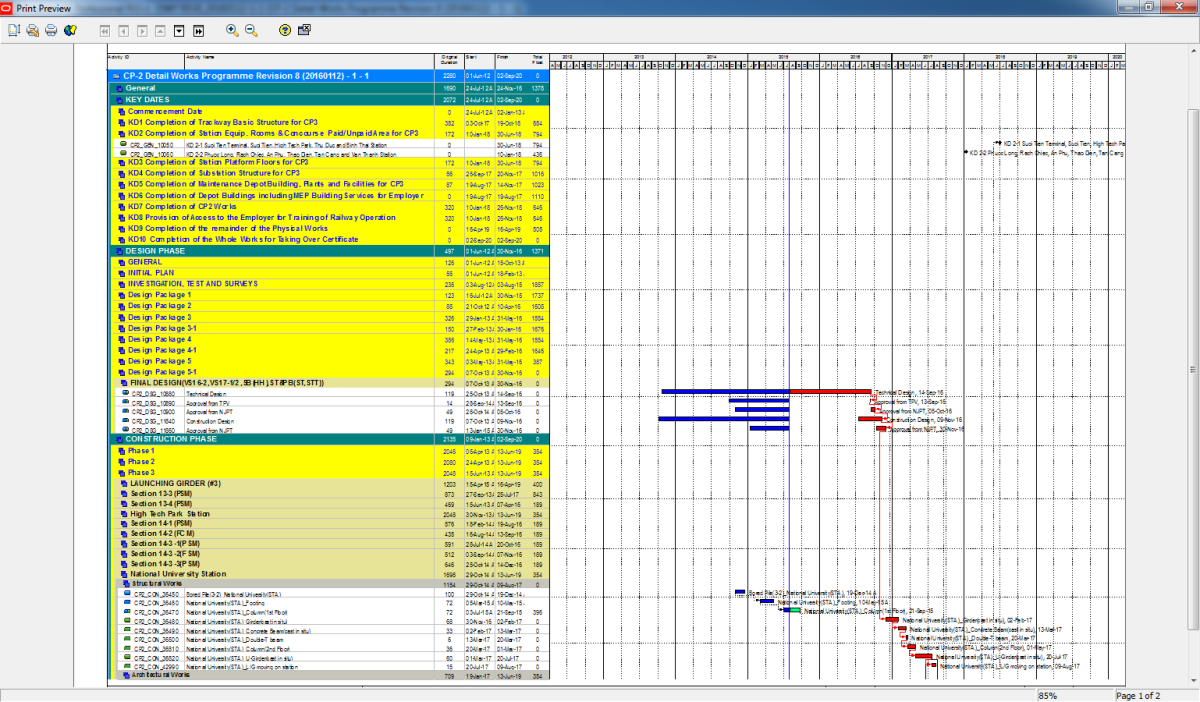

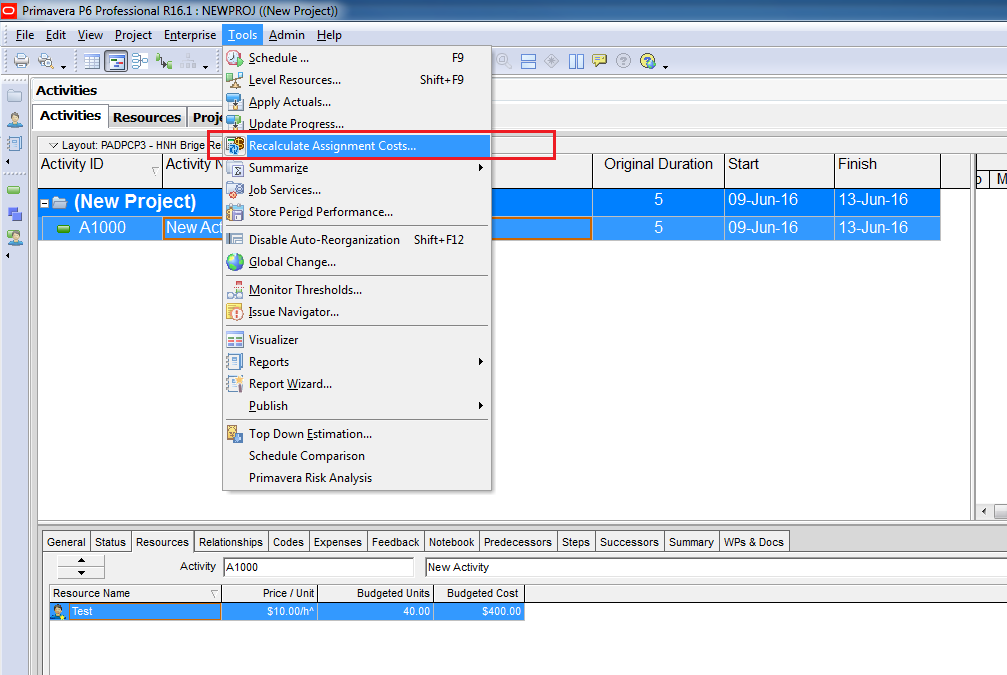

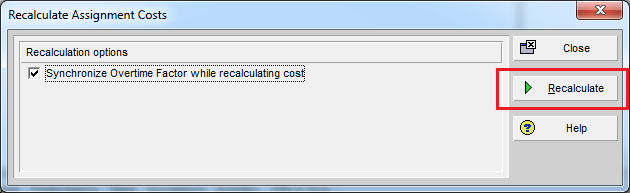

Figure 1 shows a summary of the risk management process and its connection with the forecast.

Figure 1 – Risk Assessment Process/Forecasting Process

Phase 1 – Identify Risks

The first step is to identify all risks that could realistically affect the project. This activity is best performed by the project team rather than by one individual. Depending on circumstances, it can be useful to obtain input from your customers, subcontractors, vendors, and other stakeholders involved in the project. Engaging them in the process can help your stakeholders become more committed to the project.

The approach used to identify the risks for our example was a brainstorming session.

In a brainstorm session a team works together with the help of a facilitator. The facilitator encourages everyone to participate in a free-flowing conversation amongst a group of knowledgeable people without criticizing or rewarding ideas. S/He provides guidance throughout the meeting by using structured questions and templates to foster the discussion.

Ideally, all stakeholders should eventually participate in the brainstorming sessions, but the initial Risk Identification Workshop should be restricted to a small number. Choose those who will be full-time members of the project team, have key responsibilities, and cover critical technologies and processes. As the project moves along, new workshops should be performed to incorporate more stakeholders and update risks already mapped.

Prior to the Risk Identification Workshop, participants should receive support documentation such as the statement of work (SOW), the baseline budget and current forecast as well as the Risk Breakdown Structure (RBS) and Work Breakdown Structure (WBS).

The dynamic of the brainstorming session should be discussed between the project manager and facilitator. For example, deciding if discussions will be conducted according to the WBS or RBS, identifying the participants, and defining the number of participants per knowledge area.

During the session, all potential risks are captured by the facilitator and then condensed and refined in order to be validated and classified.

The template used to identify each risk has the following fields:

- Risk Description

- General Information

- Causes

- Potential Impact (Time-Days)

- Potential Impact (Cost- $)

- Period of Occurrence

- Risk Status (Active, New, Completed, Canceled)

- Category (RBS classification)

- Risk Classification as Opportunity (+) or Risk(-)

Phase 2 – Qualitative Analysis

The Qualitative Analysis consists of the methods used to prioritize the risks identified.

Each risk is classified on three variables: impact on cost and schedule, probability, and importance to the project. To simplify the analysis, the importance to the project was indicated by the multiplication of probability times impact.

Tables 1, 2 and 3 show the range used to estimate the severity of the impact and the probability of the risk occurring.

Table 1 – Schedule Impact

Table 2 – Cost Impact

Table 3 - Probability

Based on the complexity and size of the project, a risk tolerance with a lower limit of 4% and an upper limit of 14% was used, which means that risks with a probability and impact higher than 15% are considered severe and therefore must have a risk response.

Phase 3 – Quantitative Analysis

The Quantitative Analysis consists of evaluating the magnitude of the risks previously classified. It incorporates cost and schedule impacts and evaluates pessimistic and optimistic scenarios.

Based on the forecast and the baseline budget, it was possible in our example to identify potential impacts on schedule and cost.

An expected monetary value (EMV) was calculated for the list of prioritized risks by multiplying the probability (P) times the potential impact (I) in cost.

EMV = P x I

Figure 2 – Matrix Probability vs Impact

Phase 4 - Risk Response

Risk response determines actions and responsibilities to keep track of each risk identified and prioritized.

The response should be aligned with one of the following risk strategies:

- Avoid: Change the project or some assumption to protect the project against the impacts.

- Transfer: Transfer the consequences of a risk to a third party.

- Mitigation: Aims to reduce the consequences or probability of happening.

- Acceptance: Incapability of pursuing another risk strategy or consciously assume the risk.

- Exploit: Aims to foster the probability of an opportunity happening.

- Share: Used when a partner has a higher potential to capture the opportunity.

Phase 5 - Risk Monitor and Control

Risk monitor and control consists of identifying, evaluating and planning the risks and responses.

New risks can be identified during the project and should be included and tracked with a list of risks at the management team meetings. Severe risks and their impacts, probability, EMV and responses should be reviewed monthly.

Phase 6 - Integrating Risk with Forecast

After quantifying the risks, the forecast will be split into 3 different scenarios: optimistic, most probable and pessimistic.

The pessimistic scenario incorporates the EMV of risks and the optimistic scenario incorporates the EMV of opportunities identified. The most probable uses the forecast as is.

Graph 1 shows the forecast scenarios distributed through the year.

Graph 1 – Forecast Scenarios

Graph 2 – Risk and Opportunities – Expected Monetary Values (EMV)

Graph 2 shows the distribution through the year of the expected monetary values for risks and opportunities quantified. These numbers were incorporated into the revenue forecast and can be detailed as shown in the table below.

Table 4 – Details on EMV

By using the results from the qualitative and quantitative analysis one can improve the accuracy of the forecast and also support the understanding of the nature of the work being executed. It demystifies the work and its associated risks to top executives and the project management team.

Before introducing the risk assessment into the forecast process, executives in our example project had a hard time understanding why there was often a large difference between the forecast and the actuals, as some months would vary by almost 50%.

Graph 3 shows how volatile and hard to control the environmental industry is, breaking down the risks according to its source.

Graph 3 – Risk Sources

Observing Graph 3 it can be seen that almost 10% of the risks were unforeseeable. They were related to forces of nature such as rain, snow, wildfires, or accidents. Another 75% were related to external sources such as permits, taxes, regulations, other contractors participating in the project, clients, unions, competition, environmental conditions, the economy and market forces.

Being able to anticipate when most of these risks will happen, and to quantify and incorporate them into a regular forecast process, enables the project team to be more accurate and aware of potential risks and opportunities. Forecasts should be revised on a regular basis, and risk should be one of the topics discussed and updated.

Conclusion

It is widely accepted that risk management is a key contributor to project success, but integrating it into the forecast process can add even more value to the project.

There is no magic bullet to implement a process like the one presented in this paper, but there are some key guidelines you can follow. With that in mind, the following simple steps may help guide you as you begin planning your process to evaluate risk and improve your forecasts.

- Define what values your project and organization will gain from this approach. Examples: reduce volatility to enable a more efficient use of capital. Increase customer satisfaction and transparency. Obtain the project and company goals – a project on budget and on schedule and a more accurate company’s forecast for the market.

- Seek support and help. Get the involvement of your team and an executive sponsor. Explain the value of the process to the project and the organization.

- Use templates to keep the process simple and straight forward.

- Start in a small group with the core management team. Extend to other stakeholders once the process is more refined and established.

- Keep the ball rolling. Define regular meetings with the project team to revise the forecast and risk analysis. Look for unanticipated risks as you already mapped and decided how to deal with the expected ones. Explore the different scenarios.

- Support the development of an organizational knowledge base. Create a database for the risks mapped and share with your team and organization.

- Develop a monthly report with the three scenarios forecasted and highlight the most relevant risks and upcoming opportunities.

Appendix - Glossary

- Risk is an uncertain event that may result in a positive or negative impact on project objectives.

- Qualitative Risk Analysis is the process for prioritizing risks for subsequent further analysis or action by assessing and combining their probability of occurrence and impact.

- Risk probability and impact assessment is a method for "investigating the likelihood that each specific risk will occur" and a method for explicating their "potential effects" on the project which can be positive (risk is an "opportunity") or negative (risk is a "threat")

- Risk Severity is a risk classification in terms of impact and probability of occurring. The tolerance to risk will define the thresholds.

- Brainstorming is an information gathering technique used to collect requirements for the project. Uses the project team or experts to creatively identify risks, ideas or solutions.

- RBS: Risk Breakdown Structure

- WBS: Work Breakdown Structure

- Risk categorization is the act of linking identified and evaluated risks into the RBS or WBS.

- Quantitative Risk Analysis is the process for numerically analyzing the effect on overall project objectivities of identified risks. Based on the results of the Qualitative Risk Analysis the Quantitative Risk Analysis is performed on risks that have been prioritized.

- Expected Monetary Value Analysis (EMV) determines an overall ranking of risks multiplying the probability times the impact of the risk, creating different scenarios that may or may not occur.

References

- Real-world Risk Management. White Paper. PMI. http://www.pmi.org/Business-Solutions/~//australia/media/PDF/Business-Solutions/Risk%20Management_FINAL.ashx

- Project Management Institute. (2015). A guide to the project management body of knowledge (PMBOK® guide) – Fifth edition. Newtown Square, PA: Author.

Australia

Australia International

International

Blogs

Blogs Glossary

Glossary Templates

Templates Videos

Videos Paperback Literature

Paperback Literature